Did Christie’s New York Contemporary Art Day sale's format build on the learnings from the 2008 crisis?

Posted by Pi-eX Research on 20th Oct 2020

The year 2020 undoubtedly demonstrated the auction houses' ability to show flexibility, as they adapted to restricted market conditions at an unprecedented pace. While Sotheby's moved a large share of its live auctions online, Christie's was the first to adjust its traditional calendar to bypass uncertainties overshadowing US elections and potential pandemic developments, rescheduling its main November 2020 New York sales for October.

Thus on October 7th 2020, Christie's hammered its Fall Post-War & Contemporary Art Day auction live from New York. A close observation of sellers' and buyers' actions shows that, while business is far from usual in the art world, Christie's strategy for the sale may have provided the right environment for future growth.

1. At a time when sellers may hesitate to sell, Christie's put together a careful and well-fitted offering for its New York Fall Post-War & Contemporary Art Day Sale, with perhaps the 2009 crisis in mind:

In addition to the cautiousness which Christie's observed shifting the sale to an earlier and less uncertain timing, the auction house adapted carefully to the current market conditions - and most likely to sellers caveats - while designing its offering for the Contemporary New York autumn repeating day sale:

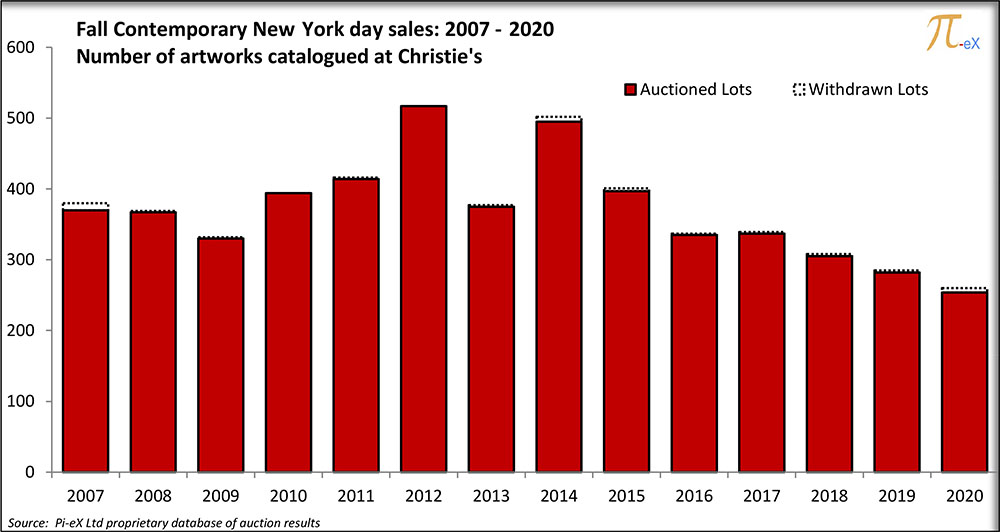

- first the auction house did not dramatically reduce the number of lots consigned but rather continued the steady trend started 5 years ago to decrease the number of lots offered at the sale.

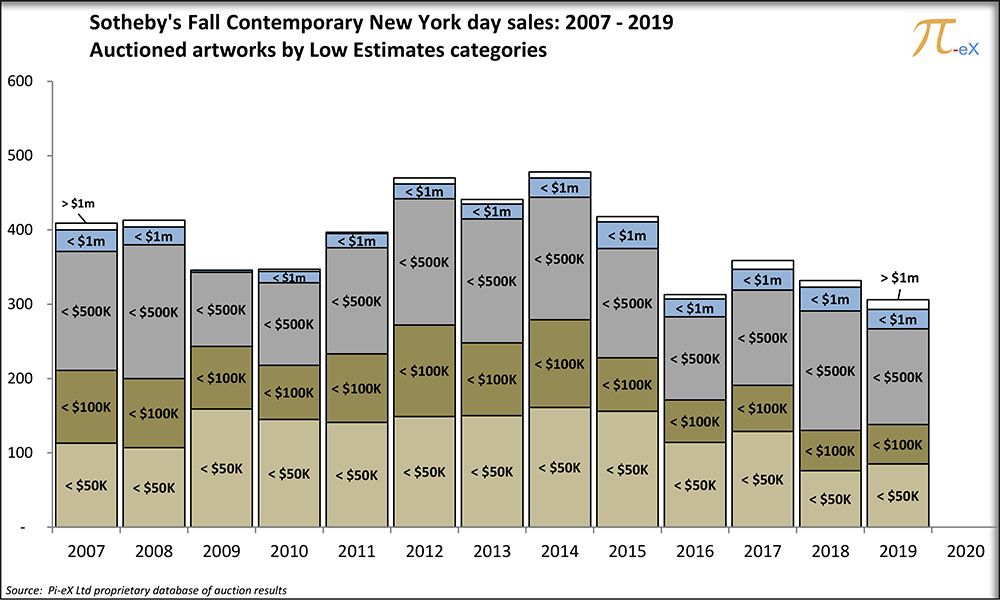

- Second and more noticeably, Christie's put together an offering of works featuring more artworks with lower Low Estimates (LE).

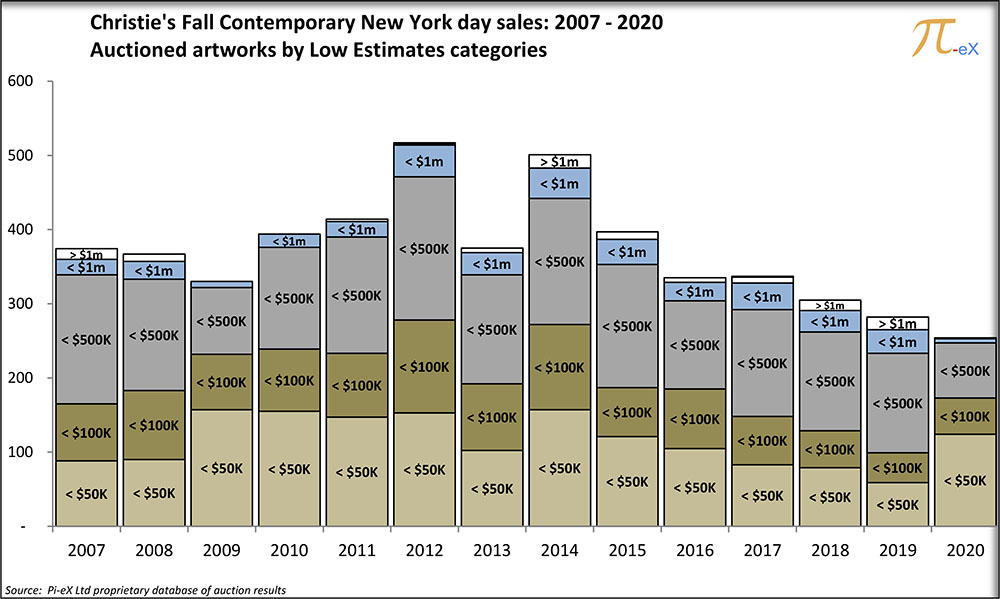

As seen in the graph above, the auction house increased the number of artworks auctioned with a LE of less than $US 50K and decreased the offering of lots above $US 100k, most likely as it faced difficulties to convince sellers to consigned artworks in the higher price point categories.

In doing so, Christie's brought an end to the trend observed since 2014, which consisted in increasing the selection of artworks with a LE above $US 100K and reducing the offering in lower-priced lots.

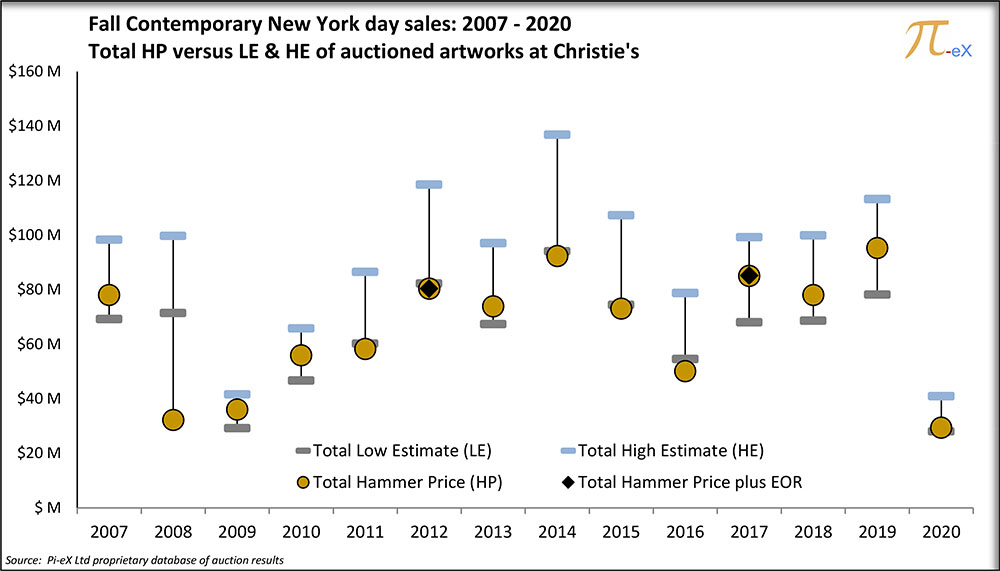

This year's reduction in lots bearing higher estimates resulted in lowering dramatically the total Estimate of auctioned lots, as shown in the above graph.

The 2020 drop in total LE looks very similar to that of November 2009, when having experienced the unexpected November 2008 burn, Christie's adapted its offering mix to sellers and buyers expectations.

Dwelling into what Sotheby's also did under the same circumstances in 2009 for the equivalent sale suggests that shifting auction mix to lower-priced artworks is the scheme that auction houses followed after having experienced a downturn the year before.

2. A closer look at historical results show that auction house professionals might have potentially help sidestep a 2008 scenario:

Did Christie's 2020 strategy for its Fall New York Post-War & Contemporary Art Day sale allow it to avoid a dramatic fall in performance?

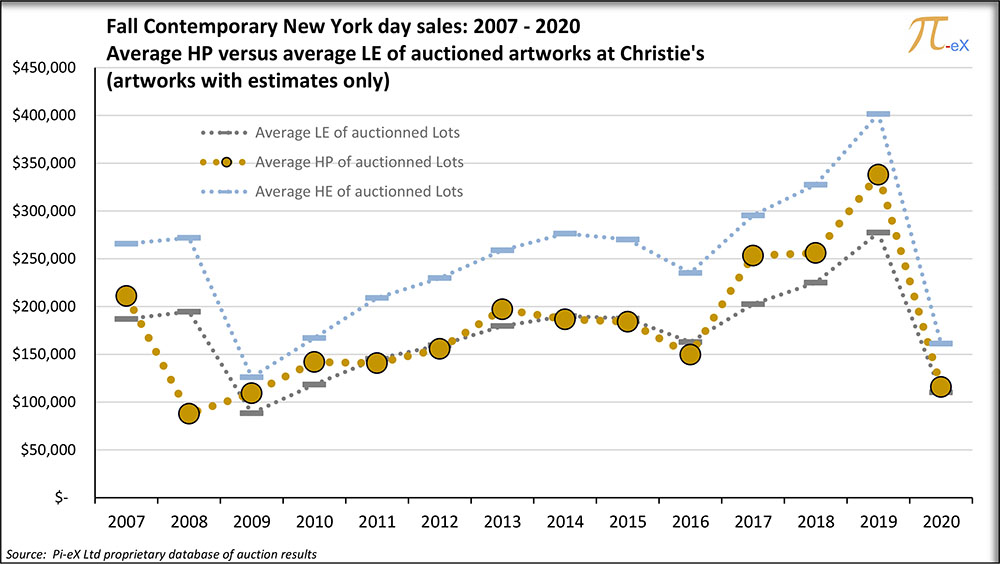

With a range of estimates lower and more suited to the market environment, the chance of Hammer Prices (HP) reaching Low Estimates (LE) is higher and this is what happened this year.

Should the auction house have maintained the same level of estimates as last year for this year, it could potentially have resulted in Hammer Prices far lower than estimates and most likely severely erode market confidence.

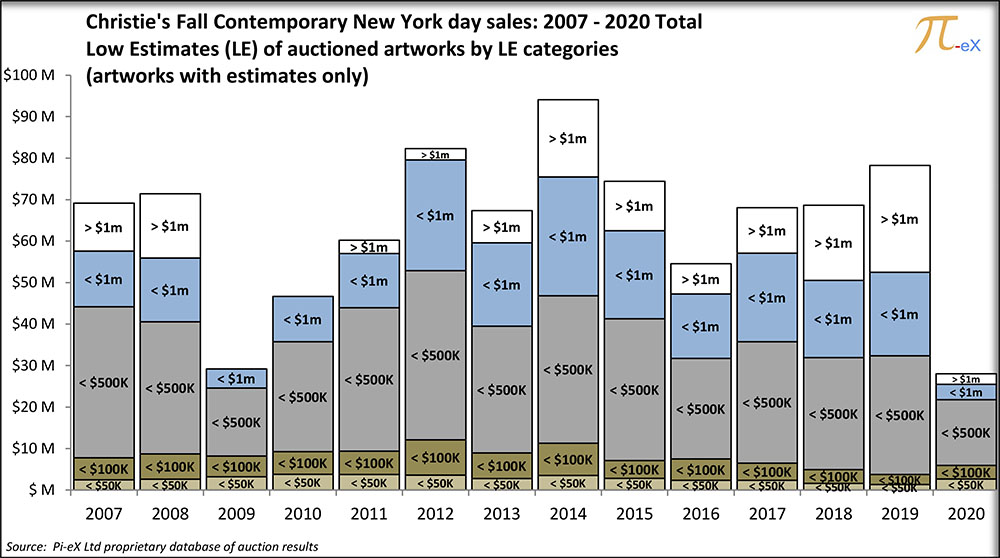

While the range of estimates for 2020 and 2009 look similar for the Christie's Fall New York Post-War & Contemporary Art Day sale, the years before the estimate correction (2008 and 2019) look widely different as shown on the graph above.

While the crisis of 2008 hit the auction houses by surprise in the fall 2008 and resulted in a terrible burn that they had to re-adjust from, 2019 was a great performing year with a growing New York Fall Post-War & Contemporary Art Day sale. It seems as though drawing lessons from the 2008 crisis won the auction house the one year time lag in its adequate response and saved it from the level of bought-ins that an ill-suited offering could have induced.

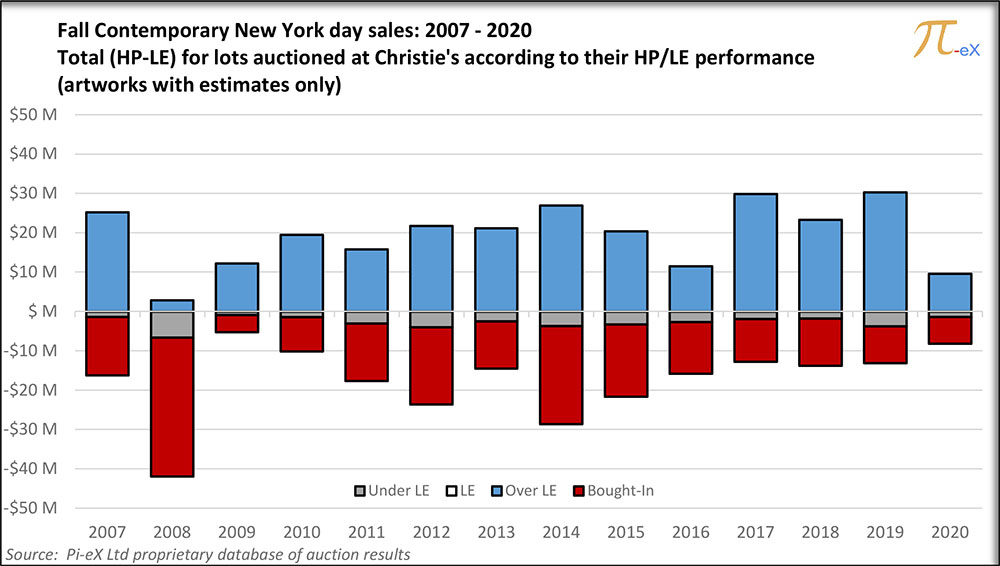

Looking at the historical results in terms of volatility profile reinforces this hypothesis.

The graph above, showing the difference in value between Hammer Prices and Low Estimates, depicts both the upside for sold lots (the blue bars) and the downside for bought-ins (the red bars). As November 2008 hit, the red downside dramatically weighted on the sale's small upside. The 2020 volatility profile resembles much that of 2009, with both contained upside and downside - read little volatility - but with no previous year of tremendous downside.

Although this year's downturn is far from the 2008 liquidity crisis, Christie's suited response to current market circumstances might have been curbing the impact of the crisis on the Contemporary Art market, as Christie's professionals' experience and feeling of both supply and demand seem to have spared the auction house a fall similar to 2008.

Source: Pi-eX MICRO Contemporary Fall NY Day Sales Results at Christies – 2007-2020 Tailored Report

Anna Benoliel contributed to this report.