While proving resilient, Christie’s and Phillips London Frieze Contemporary Day auctions confirmed the current art market trend of price softening

Posted by Pi-eX Research on 13th Nov 2020

Part of the traditional so called Frieze auctions, the London October 2020 Contemporary day sales were scheduled at Christie's and Phillips only, while Sotheby's chose to have an online Contemporary auction the same week. Christie's and Phillips London day auctions proved the day auction market resilient, thanks to an adjustment in offering, and seemed to confirm the trend observed in Paris and New York: an increased price sensitivity on the part of buyers.

With no third party guarantee to distort the results, what did the London Contemporary Frieze day auctions say about the current state of the art market?

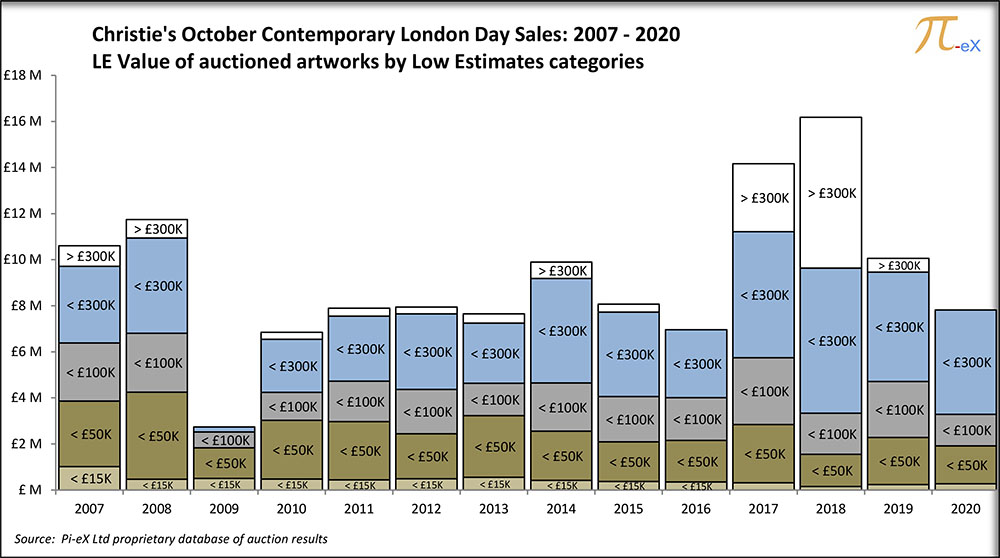

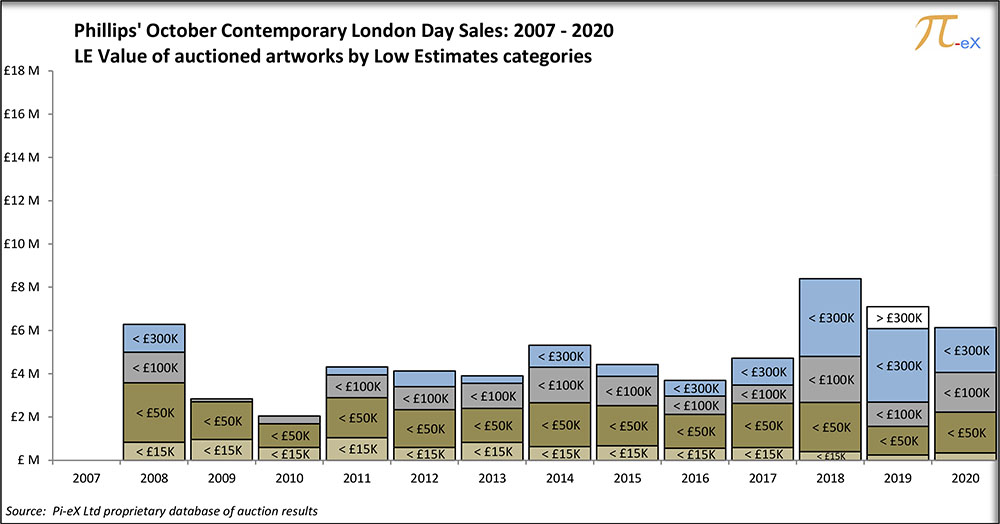

1. Christie's and Phillips both opted for a lower price point offering aligned with the trend in previous year:

After a peak in total Low Estimates (LE) offering in 2018, both auction houses adjusted their total LE offering in 2019 and this year.

Christie's reduced its offering by half over the past two years, from over £16m in 2018 to just under £8m in 2020.

During the same period, Phillips also droped its total LE offering by almost 30% from almost £8.5m in 2018 to just over £6m in 2020.

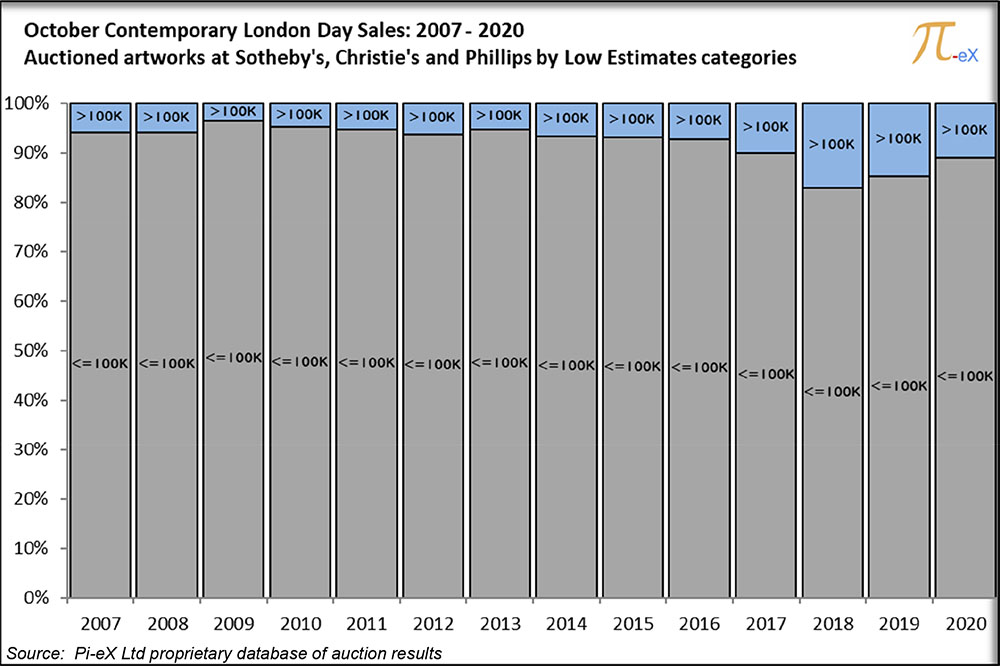

Overall in volume, there was a clear further contraction of lots with a LE of more than £100,000 in continuation to the trend started a year ago.

2. Results at both London Contemporary day auctions confirmed that buyers were not keen on overbidding while sellers were willing to part with their artworks at lower prices:

Historically the London October Contemporary Day Sales have seen very little exposure to Third party Guarantees/Irrevocable Bids (IRB), which allows for straight-forward reading of buyers' answers to the auctions' offering adjustment.

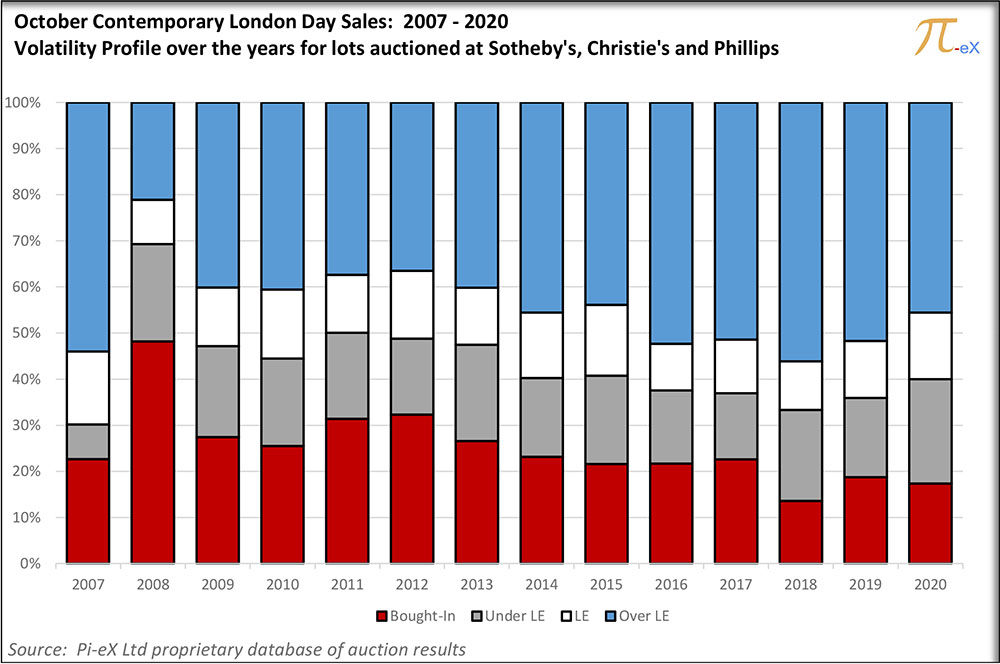

The overall performance of both sales in percentage show a clear trend of a further decline in the number of lots obtaining Hammer Prices above their Low Estimates, while the number of lots at or below their Low Estimates increased to 37%, the largest ever percentage in this category since 2007.

Notably the bought-in rate is at one of its lowest levels in 14 years, potentially showing that sellers prefer to sell at a lower price rather than going home with a bought-in.

3. In the end, a further softening in prices came as a result of a lower price point offering, met by continuous hesitation from buyers:

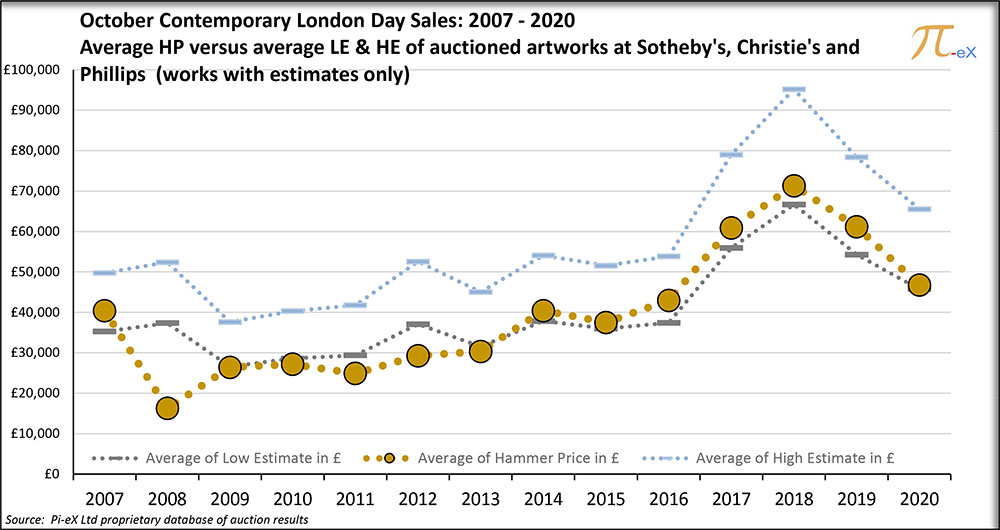

2020 saw a further drop in the average estimates of lots offered by the auction houses at the London October Contemporary Art day sales. As described earlier this was the result of a shift in offering towards artworks with lower estimates as well as a reduced number of lots.

Despite the lower estimates, the total average Hammer Price just met the average Low Estimates, reflecting the fact that fewer buyers were willing to overbid and a large share of the artworks were sold at or below their LE.

Hesitation from buyers at the London October 2020 Contemporary day sales is also visible when looking at the internal volatility of the sale.

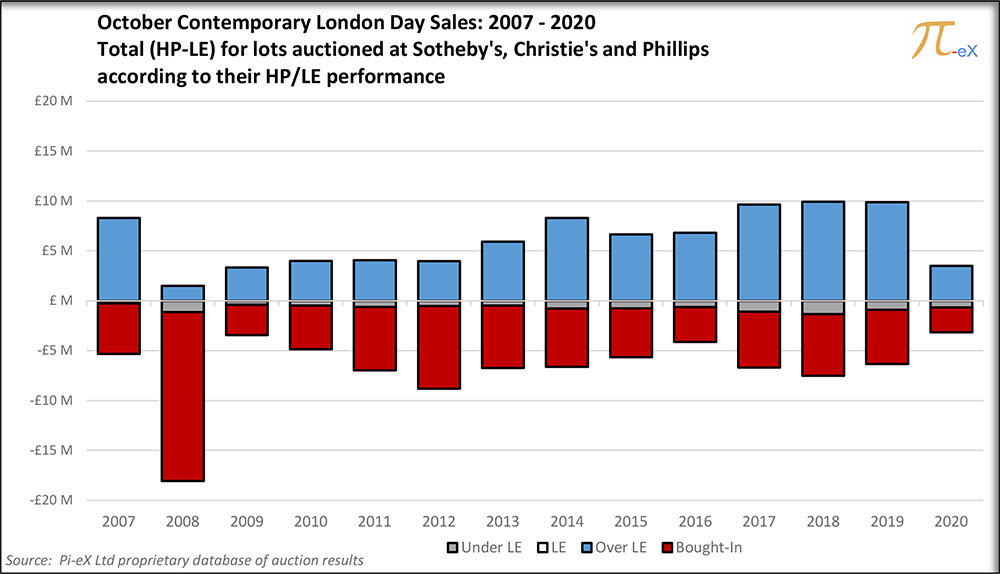

As shown in the graph above, 2020 is characterized by a very small upside (in blue) and downside (in red). While it is good news, compared to the volatility profile of 2008 (when the downside was abnormally large, due to a large number of bought-ins), the sudden reduction of upside compared to the years 2017-2019 cannot be good news for sellers and may be a sign that the price softening trend may not be over.

Christie’s Post-War & Contemporary Art and Phillips’ 20th Century and Contemporary Art day auctions during London Frieze week 2020 proved resilient, with a average total Hammer Prices falling at or above the average total Lower Estimates.

These day sales also confirmed the trend observed at other auctions in October 2020:

- lower supply in value from sellers and auction houses

- less commitment in value from third party guarantors

- less willingness to overbid on the part of buyers

- more willingness to sell at or under the LE on the part of sellers

- contained bought-in rate, most likely thanks to lowered reserve prices

Do these trends pave a way back to 2014-2016 levels of revenue for future London Contemporary October day sales?

Source: Pi-eX October London Day Sales Reports

Anna Benoliel contributed to this report.

Photo by Eva Dang on Unsplash