The success of the Frieze 2021 evening sales at the top 3 auction houses reflects a shift in the art market. Collectors beware!

Posted by Pi-eX Research on 19th Oct 2021

This October, the 2021 London Frieze Contemporary Art Evening sales achieved their best performance ever since 2007. This was a welcome outcome for the London market, after years of deceleration amid Brexit and post-pandemic uncertainties. Does this mean that the London market is back to its good old times? Not entirely. The impressive results of last week were based on two important trends that art collectors need to carefully consider when trading art: the growth of up-and-coming artists and the use of third-party guarantees for higher-priced artworks.

The Frieze London Contemporary Art Evening sales at Christie’s, Sotheby’s and Phillips achieved their best performance ever

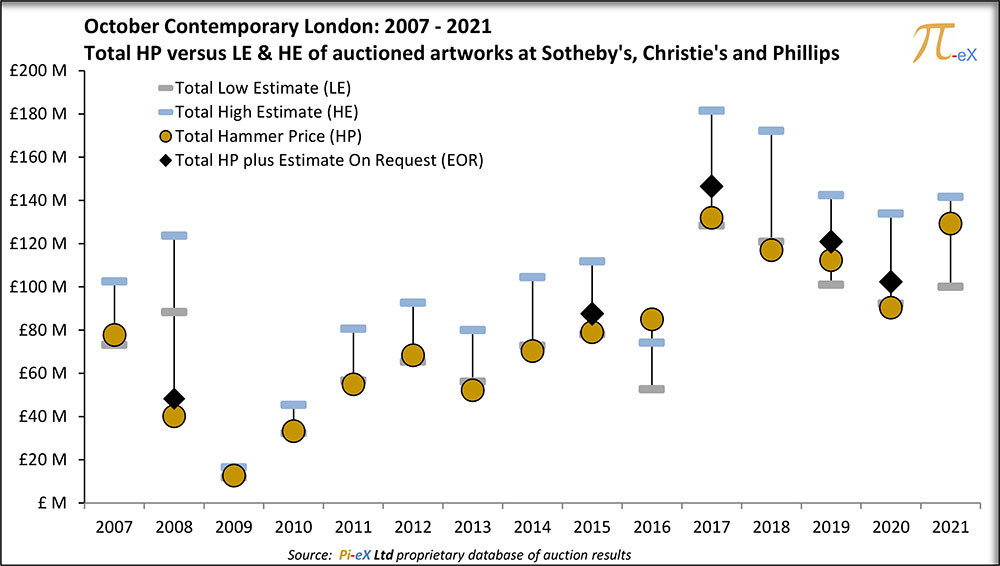

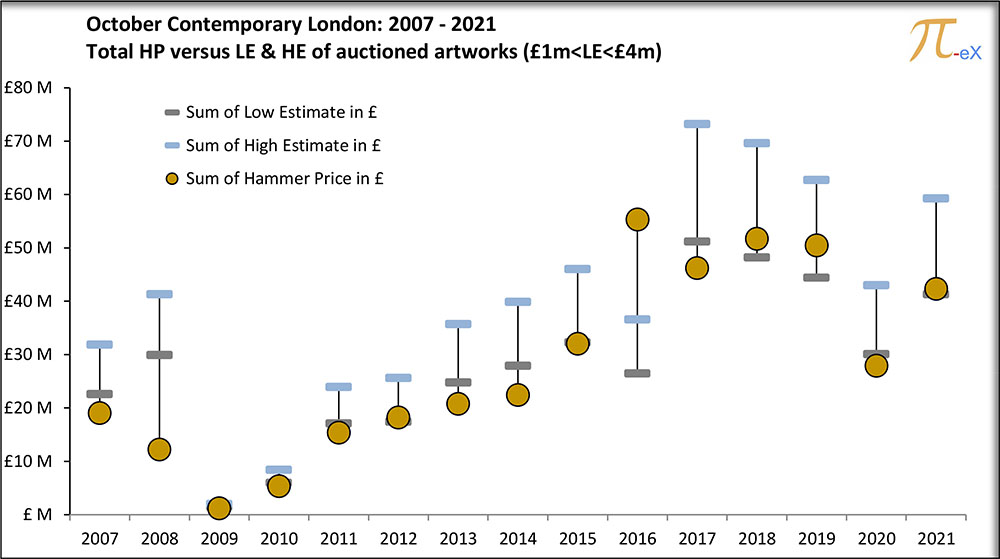

The Contemporary art Evening sales at Christie’s, Sotheby’s and Phillips last week achieved their best performance ever, with a combined total Hammer Price reaching almost £130m (US$178m), an impressive 30% above the combined total Low Estimate at £100m (US$137m).

Only in 2016 did the total Hammer Price at the combined three Evening sales outperform the 2021 results, but then both the total Hammer Prices and total Low Estimates were much lower than in 2021 at £85m ($117m) and £53m ($73m) respectively.

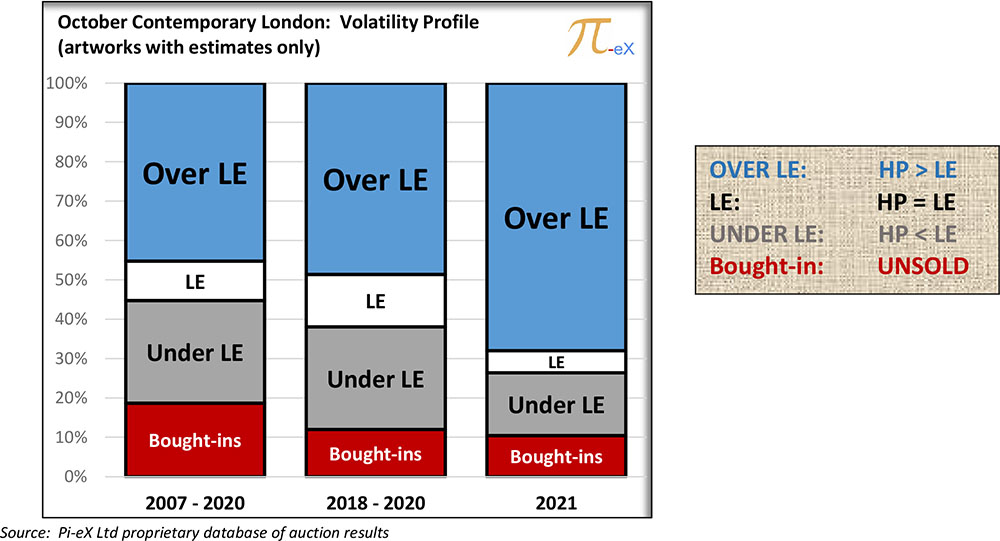

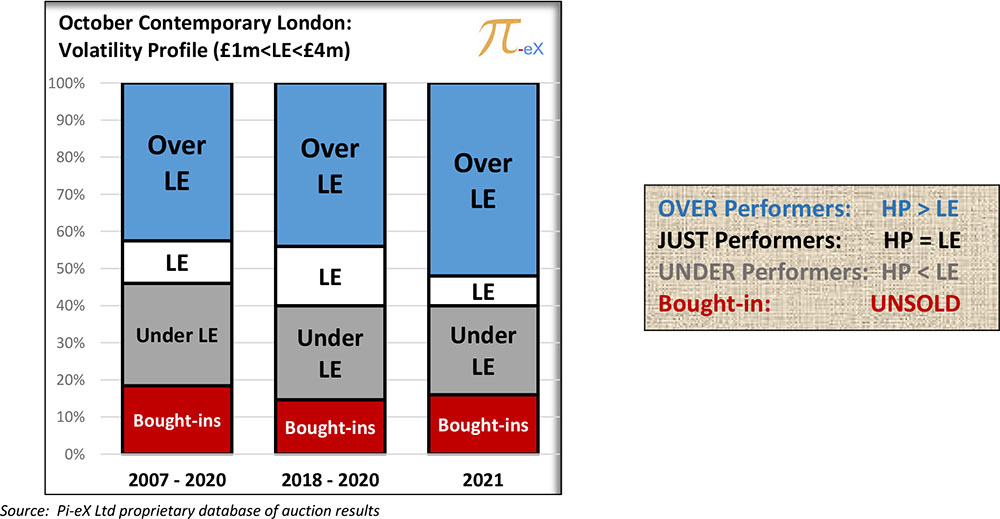

Participants to the October 2021 London evening sales will surely remember this series of auctions as full of energy, especially at Sotheby’s and Phillips where artworks after artworks achieved prices way above their initial estimates. Overall, almost 70% of artworks auctioned at the three Evening sales obtained a Hammer Price above their Low Estimate, a much-improved result versus the 50% average over the past few years.

With a Bought-in rate (percentage of unsold lots) maintained at 10%, it really felt as if artworks were selling like hotcakes and buyers could not buy enough of art.

Was that the case? Are we in a bullish market where sellers can be sure to sell their art when they wish to do so? Not exactly. It depends on what they have to offer.

What did sell really well at the Frieze London evening auctions?

- THE artwork with a brilliant story performed extremely well

"Love is in the Bin" by Banksy Courtesy of Sotheby's "Love is in the Bin" by Banksy Courtesy of Sotheby's |

“Love is in the Bin” by Banksy, also called the shredded Banksy, performed extremely well at Sotheby’s, selling for four times its estimate with a £16m ($22m) Hammer Price vs a £4m ($5.5m) LE.

|

- The many artworks (with a Low Estimates of less than £500,000) by rising artists did sell like hotcakes:

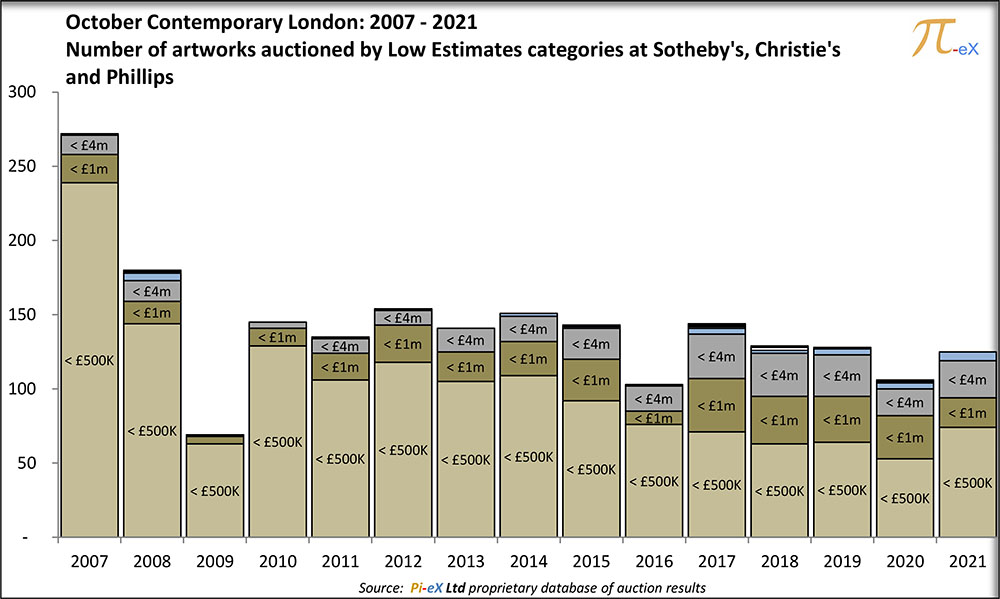

Artworks by rising artists, priced with a Low Estimate of less than £500,000, made most of the great performance of the Evening sales, hammering for a combined Hammer Price of almost £23m ($31.5m), well above the total High Estimate of £19m ($26m) - the best performance for the cheaper category of works at the London Frieze Evening auctions since 2007.

Some of the best selling artworks in this group were, Jade Fadojutimi’s "Myths of Pleasure", which hammered at Phillips for £950,000 (US$1.3m), almost 12 times its Low Estimate of £80,000 (US$110K). Also, Hilary Pecis’ "Kaba on a Chair" obtained 4.5 times its £40,000 LE (US$55K) with a HP of £180,000 (US$247K) at Christie’s. Finally, Flora Yukhnovich’s "I'll Have What She's Having" hammered at Sotheby's for £1.85m (US$2.5m), more than 31 times its LE of £60,000 (US$82K).

Notably, this performance of rising artists at Evening auctions was facilitated by auction houses, as they significantly increased the share of artworks by rising artists with a LE of less than £500,000K, representing almost 60% of the offering, the highest ever percentage since 2016.

What did not sell really well at the London auctions: - Mid-range priced artworks with estimates between £1m and £4m did not sell as well

While lower priced artworks performed well, it was obvious during the sales that demand for higher-priced artworks was not as strong.

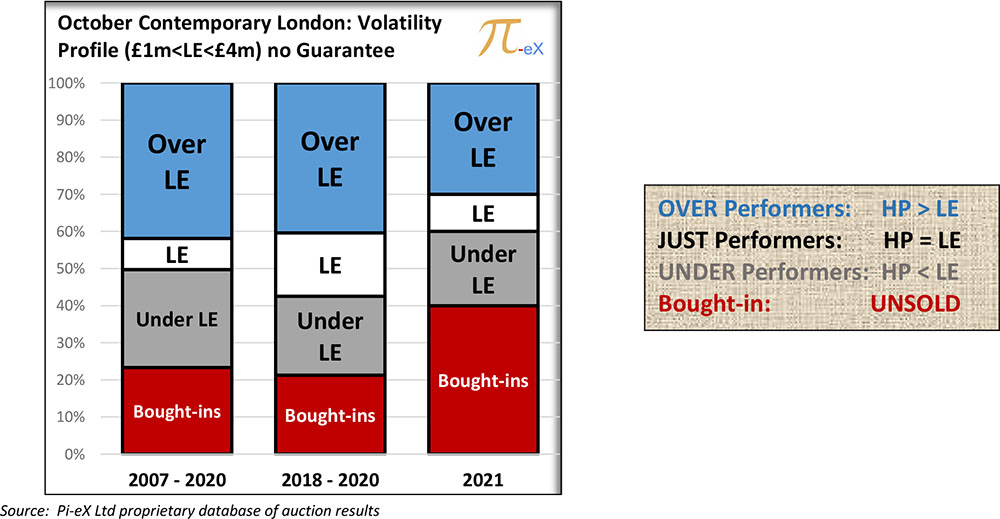

As shown above, overall artworks with estimated between £1m and £4m performed just at the total Low Estimate, with a Total Hammer Price reaching £42m ($58m).Only 50% of artworks in this category achieved a Hammer Price above their LE - vs 70% for the overall sale, as the results were hampered by a higher rate of bought-ins, (15% of lots in this category remained unsold- vs 10% for the overall sale).

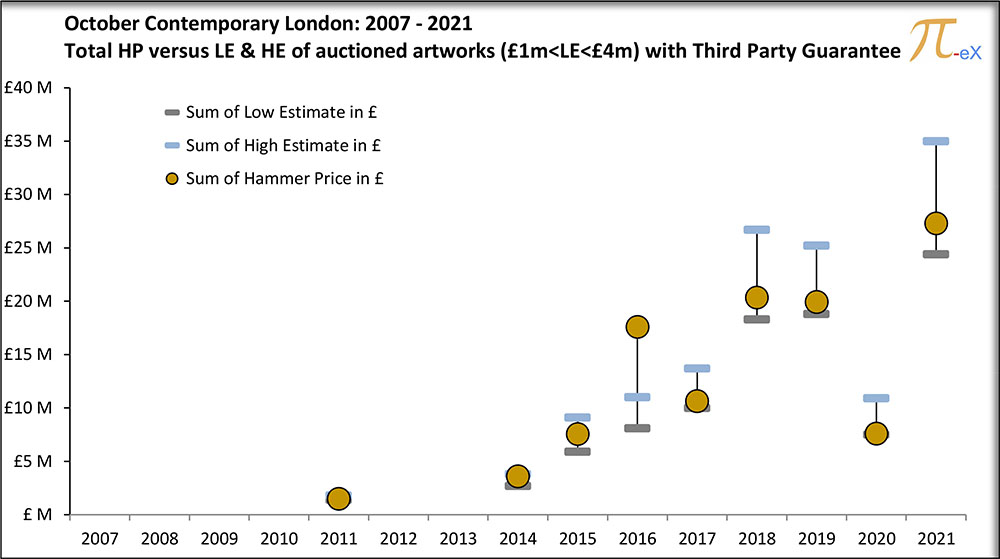

For sellers of artworks estimated between £1m and £4m, there was also a huge difference in the outcome depending on whether their lot was covered by a Third Party Guarantee or not. - Higher priced point artworks covered by a Third Party Guarantee still performed rather well with a total HP comfortably above their initial total LE

Overall, 65% of these lots achieved a Hammer Price above the LE, while 25% of artworks were sold under their LE estimate (often to the third party guarantor).

Some lots did really well, like "Mappa", by Alighiero Boetti which sold at Christie’s for £1.9m ($2.6m), above its High Estimate of £1.8m ($2.5m). It bore a last minute third party guarantee.

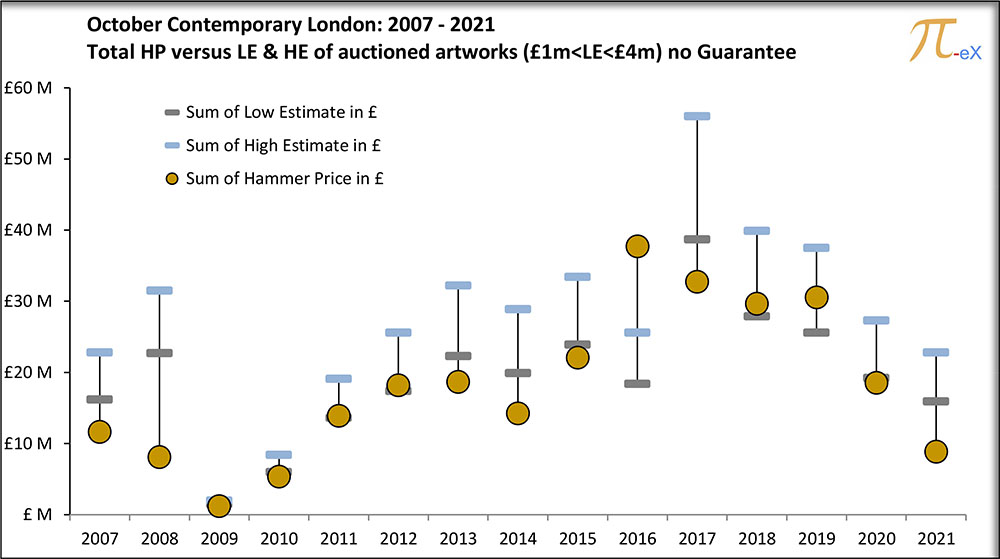

- in contrast higher price point artworks without guarantee did rather poorly:

As shown below the total Hammer Price of naked lots (no guarantee) fell well under the total LE of £16m ($22m) with an unimpressive total HP of £9m ($12m).

The results clearly suffered from a high bought-in rate at 40% - which is exactly what is avoided in the case of a guaranteed lot by a third party. In the end, only 25% of these lots sold for an HP above their original LE.

This again seems to have been anticipated by the auction houses as only 12 artworks out of 31 in the price category of £1m to £4m were not covered by a third-party guarantee.

Collectors Beware!

While the London evening sales achieved such a great performance, rushing to sell in London may not yet be a savvy move unless you do own a work by a rising artist, preferably with a Low Estimate well under £500,000, or are the lucky owner of a once in a lifetime performance artwork. If you intend on selling a work by a blue-chip artist valued over £1m, you’d better negotiate a third-party guarantee.

Source: Pi-eX Report - October 2021 Frieze London Contemporary evening sales - Standard Report

Anna Benoliel contributed to this article