The rise of NFT or the rise of ETH?

Posted by Pi-eX research on 18th Mar 2021

For a year, the fine art auction houses have been dealing with the challenges brought in by the Covid19 pandemic. Despite successfully moving their business online, Christie's, Sotheby's and Phillips have struggled, seeing their revenue from public auctions decreased 35% since the start of the pandemic over the past 12 months. In this context, the excitment of the art world by the sudden rise of digital art should come as no surprise, especially as historically the art world has often thrived on the rise of new art movements.

But is the rise of NFT the sign of a new art movement or is it the sign of a crypto-currency hype?

1. A successful move from live auctions to online only auctions:

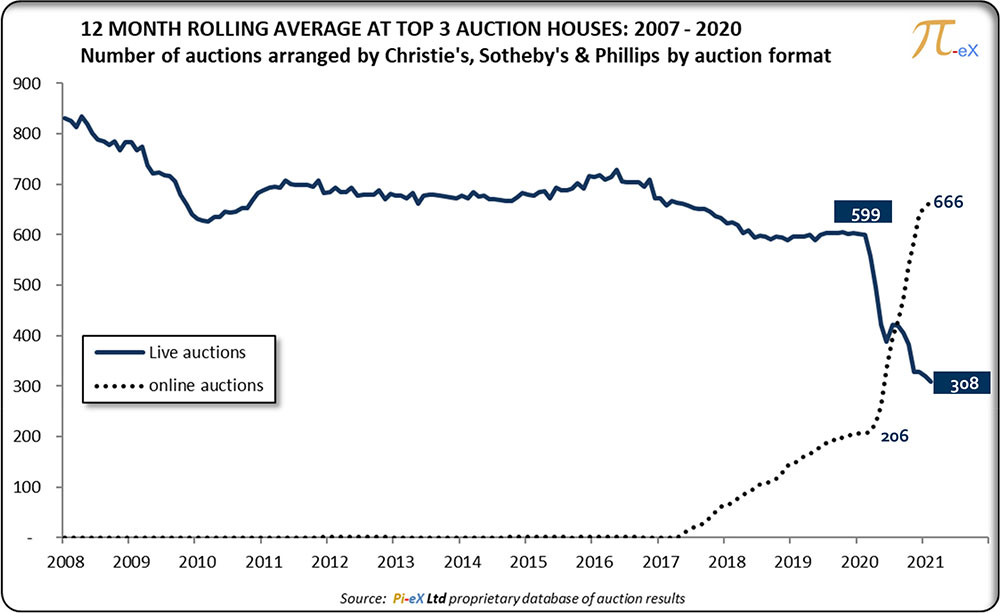

Forced to close their auction rooms to the public, Christie’s, Sotheby’s and Phillips successfully moved their auctions online over the past 12 months. As highlighted in Pi-eX latest monthly AMI report, in February 2021, more than 92% of auctions arranged during the month by the auction houses were purely online. The February high percentage of online sales reflects a dramatic shift over the past 12 months between live and online only sales. As shown in the graph below, back in February 2020, the auction houses had arranged 599 live auctions and only 206 online only auctions over the previous 12 months. Fast forward a year later and the ratio is completely reversed. As of february 2021, the auction houses had arranged 666 online only auctions and just 308 live auctions.

2. The hard sale of online only auctions:

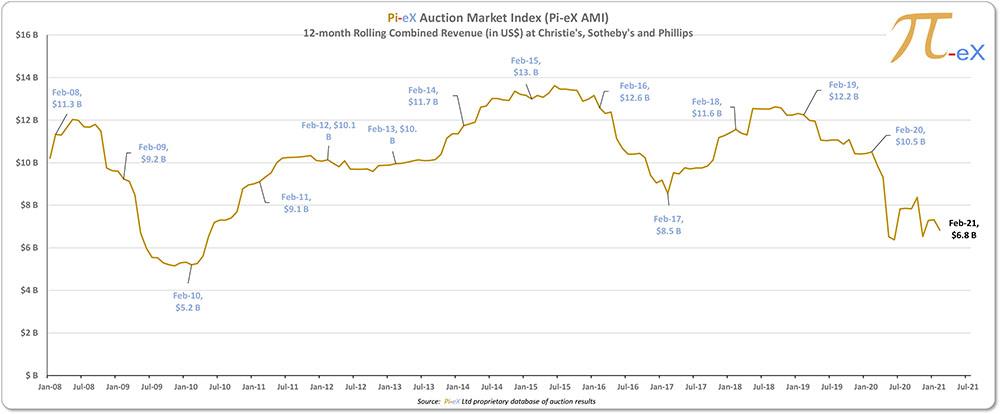

The challenge for the auction houses has been that traditional collectors have not necessarily followed them online. The lack of enthusiasm from the traditional art buyers was reflected in the Pi-eX AMI, which reflects public trade at Christie’s, Sotheby’s and Phillips. At the end of 2020, the Pi-eX AMI was down 30% year on year from US$10.4b in 2019 to to US$7.3b in 2020.

In the first two months of 2021, the Pi-eX AMI continued to fall, sliding a further 6.3% to US$6.8b at the end of February 2021. Lower trade revenue at public auctions in January and February 2021 explains the further decline.

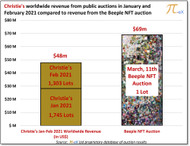

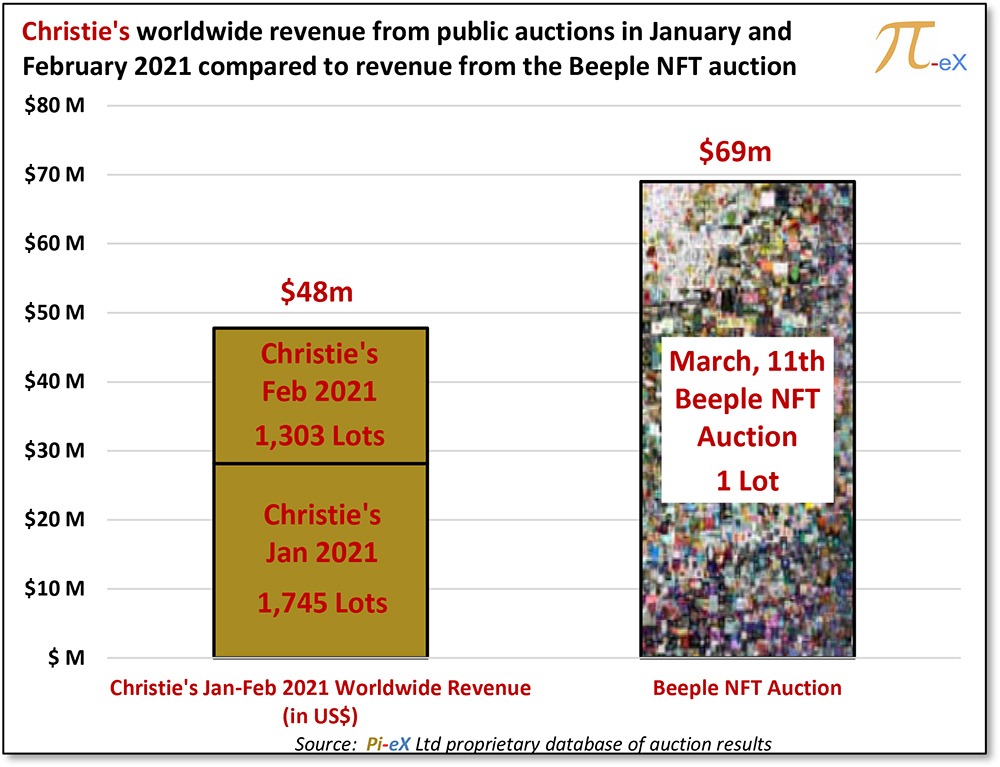

Then, in one auction, counting only one lot, the Christie’s Beeple sale generated more revenue than all the lots (over 3,000) catalogued by the auction house in the 20 auctions it arranged worldwide in January and February 2021.

3. The magic of the NFTs:

The Beeple’s NFT sale at Christie’s seems to show that there is a strong powerful interest in digital art and NFTs.

But is the interest driven by digital art or the possibility to pay in Ethereum (ETH), the crypto currency behind the smart contracts that define NFTs?

In addition to being the first “single lot” auction of an NFT artwork, the Christie’s Beeple sale was also the first sale for which Christie’s announced that it would accept payment in ETH.

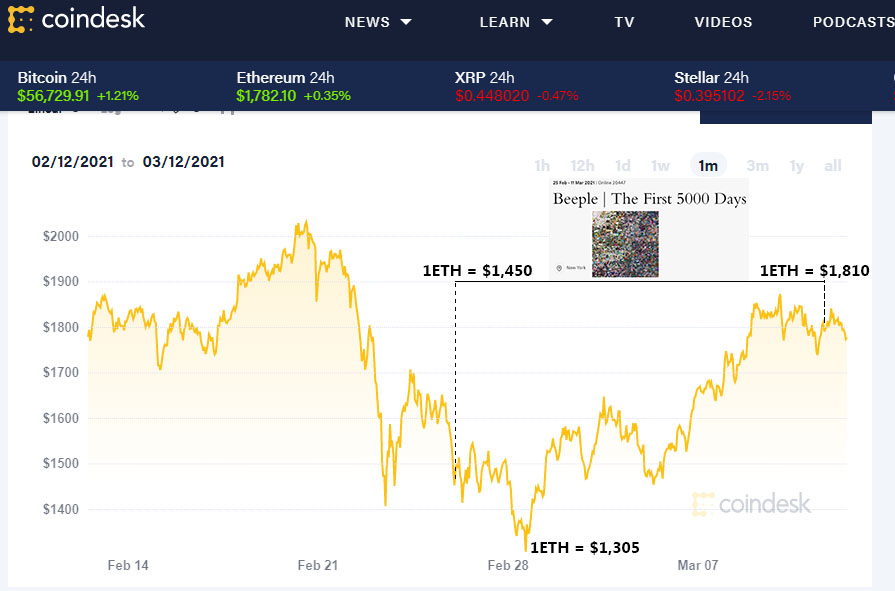

Over the past year the conversion rate for ETH has grown from a mere $100 to $1,810 on March 11th, the day of the Beeple sale. During the week long sale itself the conversion rate of ETH grew from $1,450 to $1.810, after reaching a low of $1,305 on February 28th.

In a press release after the sale, Christie’s announced that Beeple’s artwork was sold for 42,329.453 ETH. At the exchange rate chosen by the auction house, this was $69,346,250 (including buyer’s premium) but when using the March 11th rate it was already $77,310,475.

With the rate of ETH a year ago though, the artwork would “only” be worth $4,232,945.

Source: