The 2020 "Thinking Italian Art and Design" Evening Sale at Christie’s made history for the wrong reasons. Did this come as a surprise?

Posted by Pi-eX Research on 12th Nov 2020

For Italian Art sold in London, 2020 represents an unforgettable watershed year. The “Thinking Italian” evening sale arranged by Christie’s on October 22nd 2020 started well, but ended epically bad. Despite the presence of encouraging pre-sale and beginning of sale indicators, the £4.1 million total Hammer Prices (HP) achieved was the lowest performance registered since 2007. Did such a terrible result take sellers and the auction house by surprise? What might have been the reasons behind the disappointing performance?

Pi-eX’s analysis looks at the historic data and trends behind the sale.

1. All stars seemed to align at the start of the auction but there was no happy ending:

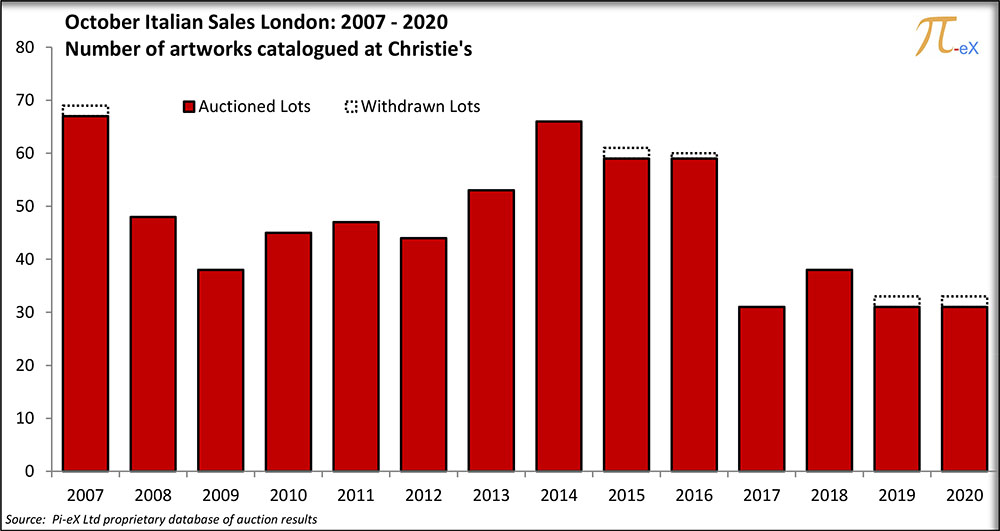

With the same number of consigned lots as last year (33), also in line with the consignment registered in the previous 3 years, art sellers seemed to show an unmuted level of confidence in the sale before the beginning of the auction.

Initially, buyers seemed to be on the same wavelength as the first three lots performed well above their Low Estimates (LE). The first lot, “Celant” by Alighiero Boetti even managed to engage prospect collectors into a fierce bidding competition, which ended by the auctioneer hammering down the lot for £450,000, ten times higher than its initial Low Estimate.

This clearly was the highlight of the sale as unfortunately, from then on, everything just got worse and worse, except for a few lots.

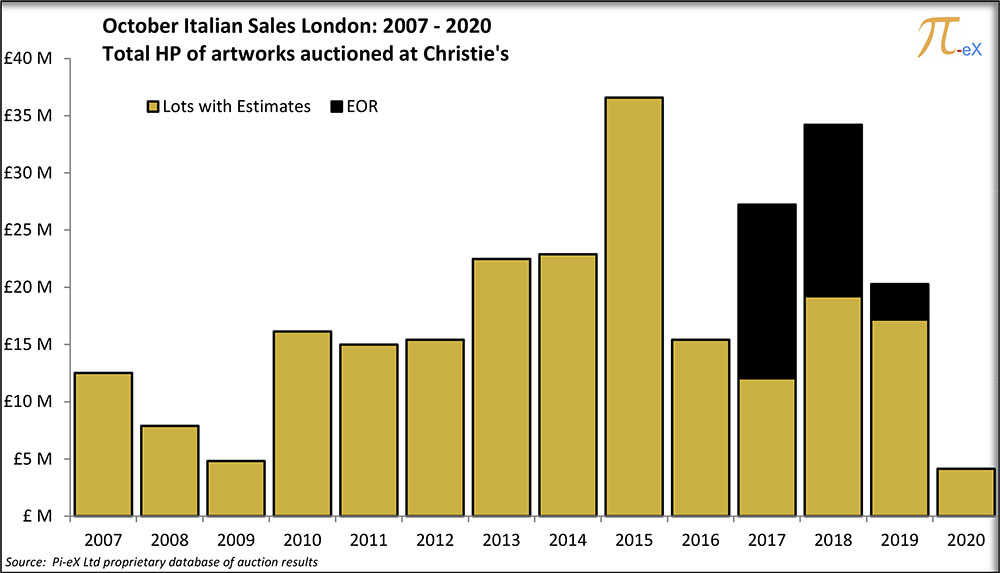

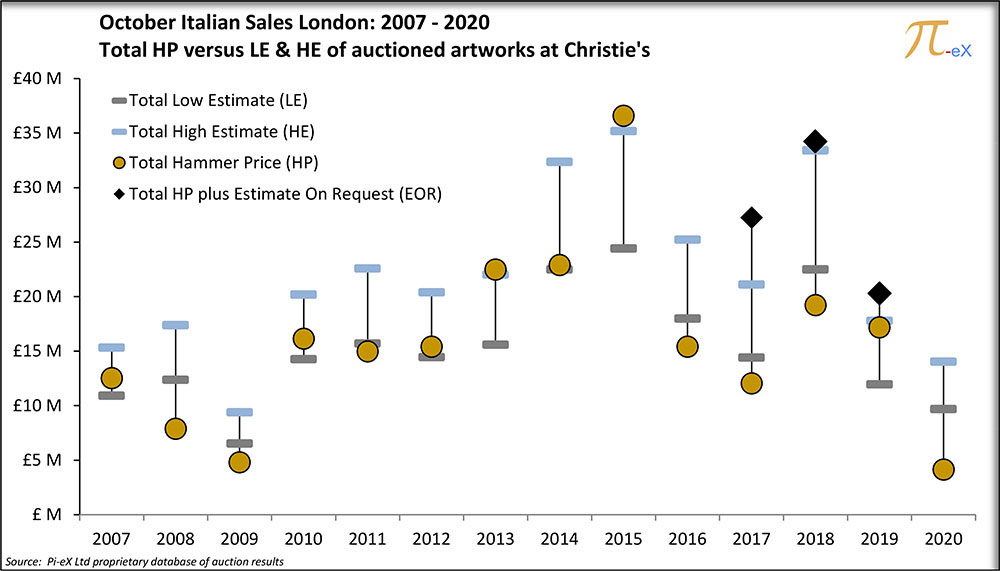

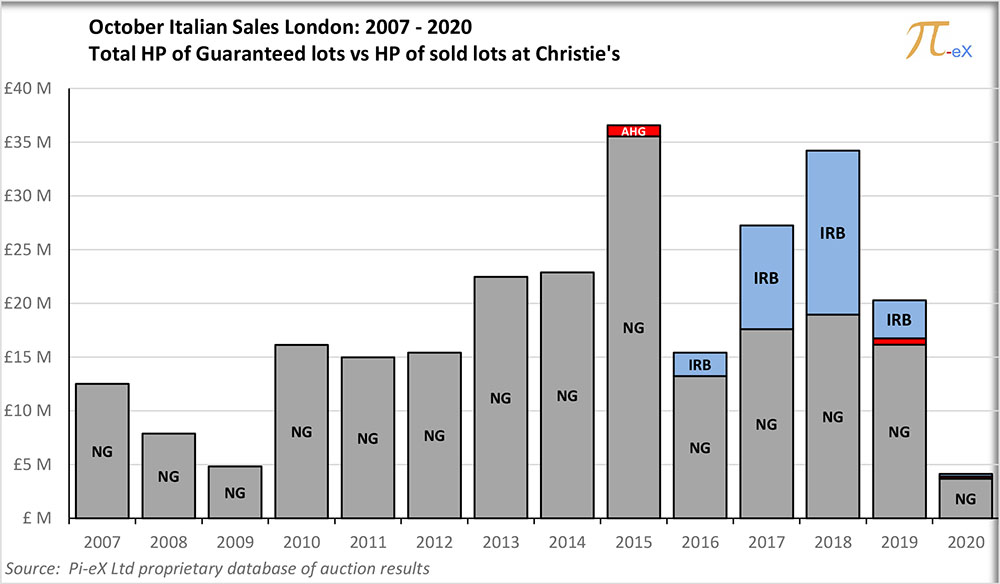

In the end the total Hammer Price (HP) achieved at the sale (£4.1m) was the lowest ever since 2007 far from the success of 2015 (£36.6m) and even lower than in 2008 (£7.9m) and 2009 (£4.8m).

2. The dramatic results of the 2020 sale show a clear disconnect between buyers and sellers:

The comparison of the sale’ s total Hammer Price with the initial total estimates shows a discrepancy between what sellers hoped to sell their artworks for and what buyers ended up buying.

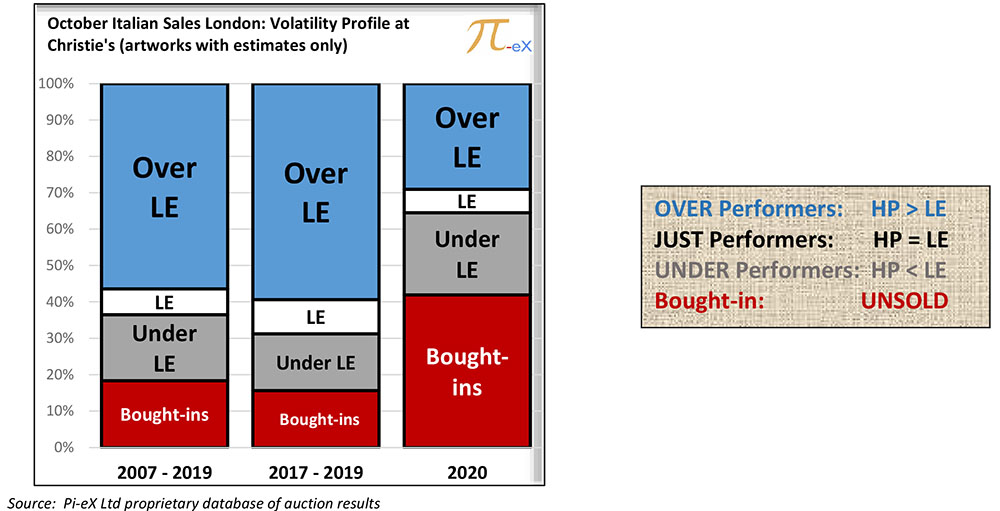

Based on historic performance, sellers at the Christie’s Italian sale could reasonably expect until this year that almost 70% if lots would perform at or above their Low Estimates. The good performance even seemed to improve over the past three years as shown in the graph below.

Obviously, this year was a significantly different story as 70% of lots performed at or below their Low estimates with more than 40% of lots being bought-in, which more than doubled the historic trend.

Clearly, buyers were not willing the match the prices expected by sellers.

How could such a dramatic change happen?

3. A close look at the recent history of the sale shows some important warning signs

From 2010 to 2015, the Italian sale showed a sound growing trend, which was interrupted in 2016 – similarly to many other sales – by a sharp drop in total Hammer Price as shown in the graph above.

The growth resumed in the next following 2 years as the total Hammer Price again came close to the 2015 results.

A close look at the 2017 and 2018 sales however shows some peculiar details:

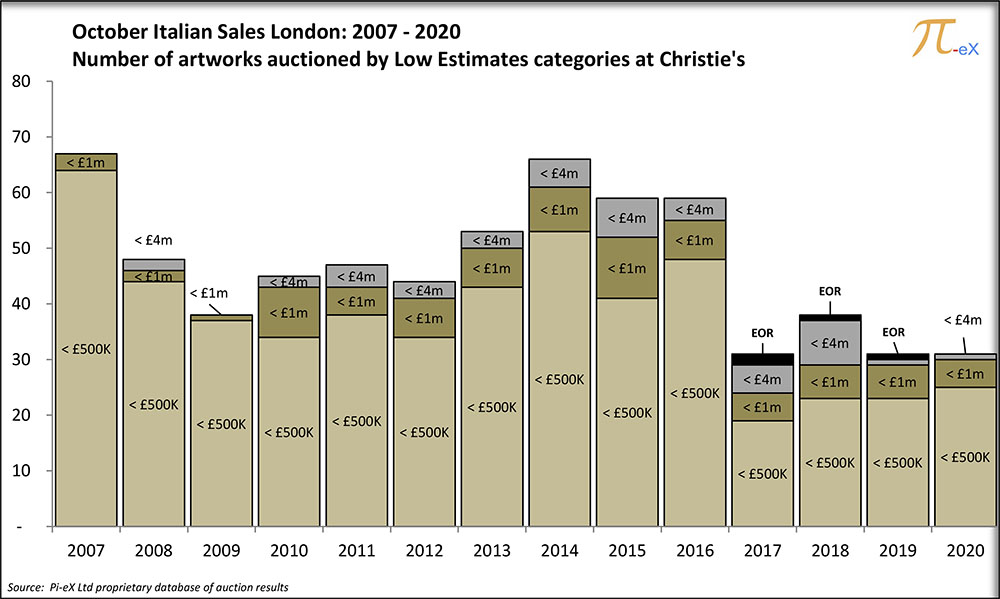

- From 2017, the number of lots auctioned at the Christie’s Italian sales was halved, usually a sign that sellers are hesitant to offer their art for sale.

The cut however concerned most of the lower price point artworks. The offering of lots with a Low Estimate of less than £500K was reduced by 60% (from 48 lots in 2016 to 19 lots in 2017) while the number of lots with a Low Estimate of more than £1m almost doubled (from 4 lots in 2016 to 7 lots in 2017):

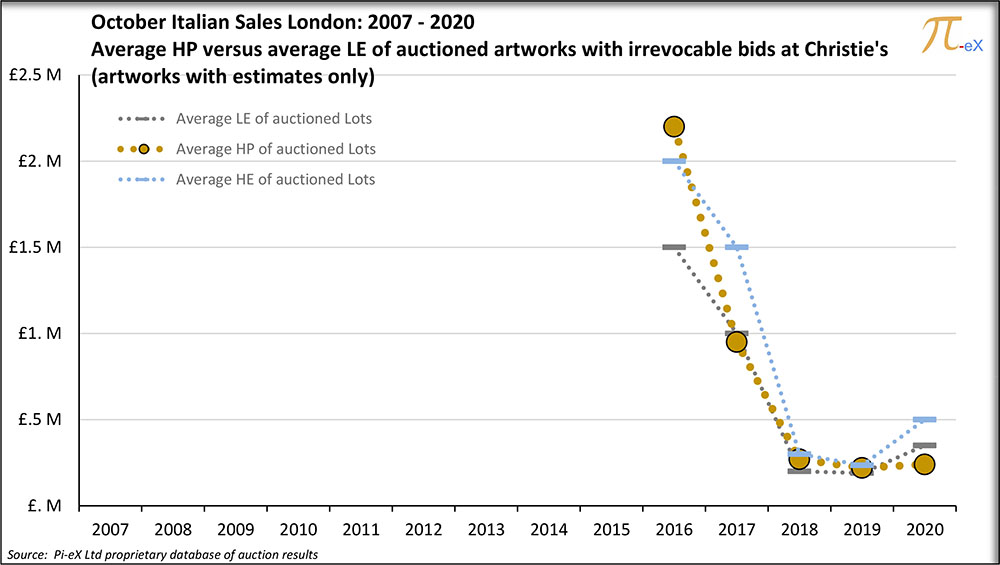

- Most of the top lots offered (with LE > £1m) were covered by Irrevocable Bids which explain a great share of the growth in 2017 and 2018.

In 2017, 2 artworks by Lucio Fontana with Irrevocable bids brought in £9.7m (based on total HP obtained) including 1 lot with Estimate on Request "Concetto spaziale, In piazza San Marco di notte con Teresita", which achieved a Hammer Price of £8.7m.

In 2018, again 2 lots with Irrevocable Bids brought in £15.3m, including again 1 lot with Estimate on Request "Concetto spaziale, La fine di Dio" which achieved a Hammer Price of £15m.

Already in 2019, the offering of top lots became thinner as there was a lower coverage in value by Irrevocable Bids and one lot by Alberto Burri, with estimates of (£2.2m - £2.8m) and an Auction House guarantee, was announced as withdrawn ahead of the sale. - The discrepancy in performance between lots without guarantees and lots with IRB shows how guarantees can affect the reading of the performance of an auction.

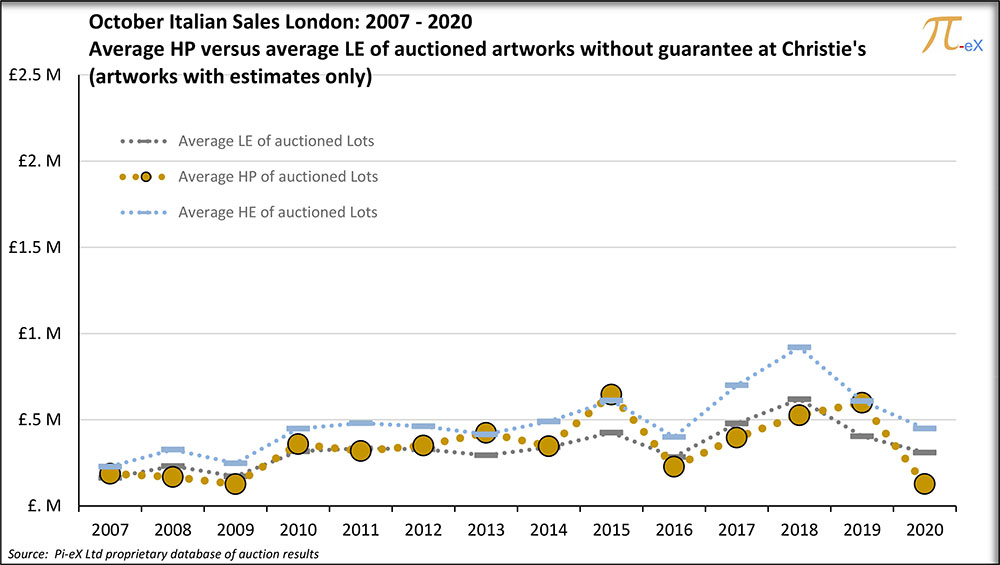

In 2017 and 2018, lots without guarantee consistently achieved average Hammer Prices lower than the average estimates, showing that buyers were already not willing to pay the increasing prices expected by sellers.

At the same time, lots with IRB allowed higher price point lots to perform above their average Low estimates, which could have been interpreted by some as a sign of great demand for lots in this category.

There might have been great demand, but one can wonder if it was not more demand for Third Party Guarantees, which had performed extremely well for Third Party guarantors until 2016, rather than for the particular higher price point lots covered by the IRB.

Whatever it was, 2020 showed that with an extremely reduced coverage of IRB, the performance of the sale collapsed.

For the past few years, the Italian sales have been boosted by Third Party guarantees/Irrevocable Bids (IRB), which have somehow contributed to the appearance of growth, not necessarily reflecting the true state of the market but certainly comforting sellers and buyers in the impression of a healthy market.

This year, the challenging situation brought by the Coronavirus pandemic plus the potential upcoming no deal Brexit have weighted heavily on the London sales. While the London Contemporary Evening sales still benefited from a steady support of IRB, the London Italian evening sale was not as lucky and the sudden withdrawal of guarantees at a vulnerable time had the most dramatic consequences.

Matteo Pace contributed to this report.