New York Mid Season Sales: a first Blossoming in a new Spring for Auction Houses

Posted by Pi-eX Research on 24th Mar 2021

Mid-season sales never fail to generate a lot of interest across art market participants.

They are an invaluable sneak peek into the current and future state of the market: their results signal the level of appetite on the buying side, just ahead of one of the key moments in the year.

As an unprecedented amount of media coverage has been dedicated to NFTs, the excellent performances of the Contemporary auctions scheduled at the same time passed rather unnoticed. Among them, Christie’s Post-War to Present, hammered in New York on March 5th, achieved $23m (including buyer's premium), while Sotheby’s Contemporary Curated reached more than $24m (inlcuding buyer's premium) on March 12th, a welcome news for art market participants, showing that there is still great interest for up and coming tangible fine art.

What were some of the drivers behind the success of Christie's Post-War to Present Sale and Sotheby's Contemporary Curated Sale? What might it suggest for 2021?

1. Less catalogued lots: a sign of hesitation of sellers or a strategy of intermediaries?

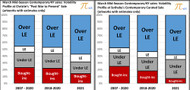

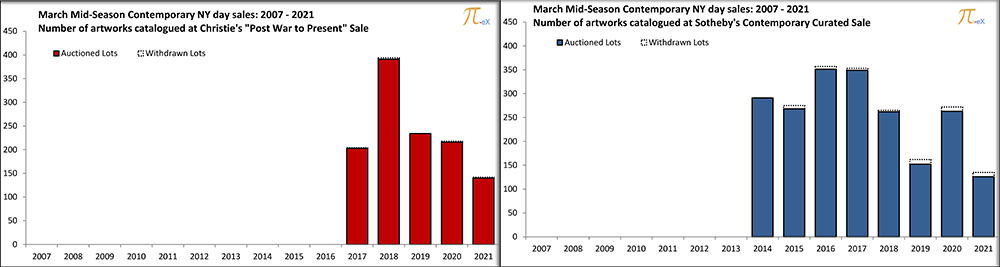

Both Christie’s Post-War to Present auction and Sotheby’s Contemporary Curated auction saw a sharp cut in the volume of lots offered for sale this year: 35% and 50% decrease vs 2020, respectively, furthering a decreasing trend which started around 2018 and 2019:

The art market is facing one of the hardest recessions of the last decades and there certainly is less supply, notably less significant Private Collections than in the past few years. The Collection of Melva Bucksbaum for example represented 30% of lots auctioned at Christie’s Post-War to Present in 2018.

However, the sales could also have been arranged with fewer lots this year to stir bidding battles and push hammer prices up. Interestingly indeed, Sotheby’s restructured its offering for Contemporary Curated and moved some of the artworks in the lower price range to its Contemporary online auction arranged during the same time frame.

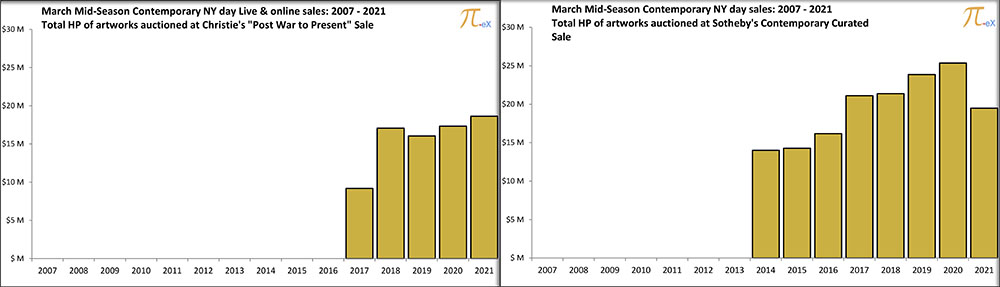

2. Preparing the blossom: the growth in Hammer Prices:

Christie's Post-War to Present auction and Sotheby's Contemporary Curated auction are definitely success stories.

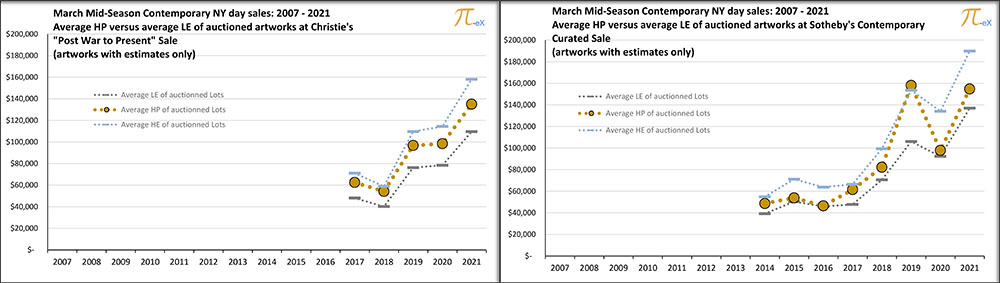

While in 2017, sellers could hope to sell their art for $60,000 on average, the average hammer price per sold artwork reached $140,000 at Christie’s and almost $160,000 at Sotheby’s in March 2021 - the 2019 peak in average prices at Sotheby's being an outlier, attributable to a single lot, Untitled (Painter) by Kerry James Marshall, hammered for about $7m versus a $2m low estimate.

The growth in average prices of sold lots reflected in a similar growth of total hammer prices for the sales. Christie’s Post-War to Present auction set this year a record total Hammer Price of $18.6m (before buyer's premium), growing 8% vs 2020 and more than doubling since 2017 the year of its first edition.

On the other hand, Sotheby’s Contemporary Curated auction reached $19.5m (before buyer's premium), decreasing 23% YoY. This is mainly due to the decrease in the value of offering, both in volume and value. With less artworks in the lower price point category, the average hammer price per sold lot jumped, but low volume in the end hurt the total revenue for the sale. The $3 million difference versus 2020 however migrated to the Contemporary online auction and was not lost to Sotheby’s.

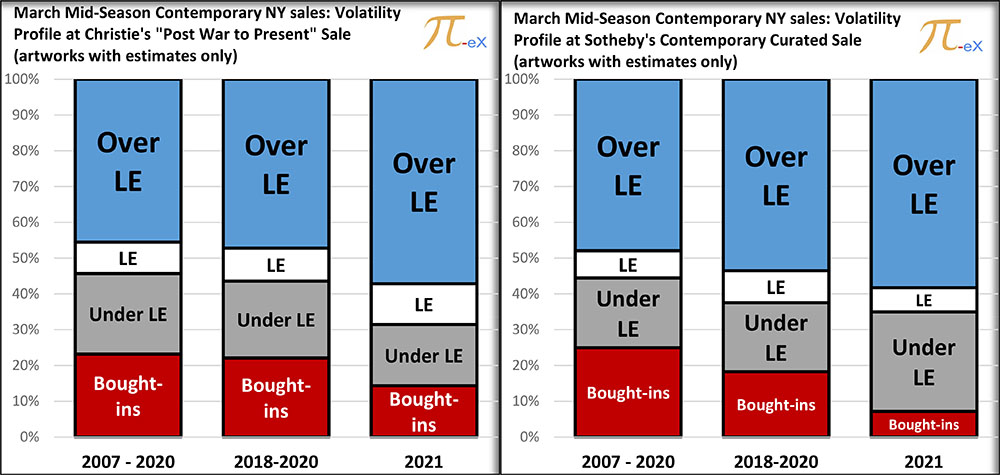

3. Boosting sellers’ mood : an exceptionally positive volatility drove the positive performance

The volatility profile, which captures the excitement in the bidding room (physical or virtual), stands out from comparable sales' performance indicators.

Enthusiasm surely dominated both bidding rooms as the sales registered their lowest bought-in rate since inception - around 15% at Christie's and 5% at Sotheby's. In addition to a very low risk of artworks being unsold (bought-in), the vast majority of auctioned artworks (60%) at the Post-war to Present and Contemporary Curated auctions obtained a hammer price higher than the low estimate.

The Midseason auctions in New York, which started with record results at Phillips New Now sale, unfolded as very good news for all art market stakeholders, and great hopes for the rebound of the Contemporary art market.

The success of this set of sales might be explained by the perfect positioning of the offering, as buyers refocus on the middle market and search for up and coming artists with lower price points.

The variety of artworks, the volume of trade, and the relative accessibility compared to the Marquee sales position the Mid-Seasons as an exciting gateway for art buyers.

Hopefully, exciting enough to boost confidence and repeat the performance in London in March, and in New York in May.

Source: Pi-eX Reports: Spring New York Mid-Season Auctions

Anna Benoliel and Matteo Pace contributed to this article