Private Collections sales: exclusively private or exclusively public?

Posted by Matteo Pace on 16th Mar 2020

While the timing of the sale of a valuable Private Collections is always unpredictable – as it is often driven by one of the three Ds (Death, Divorce or Debt), Private Collections themselves are extremely attractive for auction houses as they help create a buzz, a critical element of the sale process in the art market. Looking at historical results, Pi-eX analysis shades some light on why Private Collections are such valuable assets and how they can be best monetised.

Why Private Collections represent a business auction houses cannot afford to lose

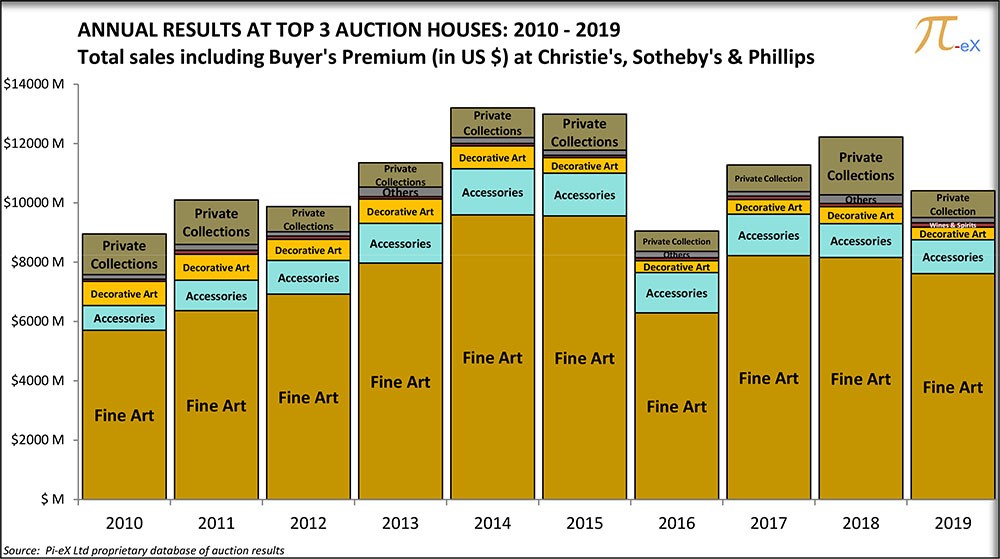

Private collections have historically represented an essential component of Christie’s, Sotheby’s and Phillips’ overall auction revenue.

The graph below helps to understand why the top-three auction houses are eager to obtain this type of consignment. As shown by the breakdown of total auction revenue in USD in the period 2010-2019, Private Collections – in olive green on the top – often are the necessary addition that makes the difference as in 2011 or more recently in 2018.

In that year, revenue from Private Collections almost trebled year-on-year from 2017, due to the perfect combination of an important consignment - the collection of the late David Rockefeller - and the creative marketing strategy developed by Christie’s in New York. The result was impressive as the collection alone generated $832M and was in many ways responsible for the growth of the market in 2018.

Exclusivity and the Fear of Missing Out (FOMO)

Historically, the trade of auction houses was focused on professional dealers, who would trade at auctions before reselling to art collectors. It is only in the late Eighties that Sotheby’s, Christie’s and Phillips started to focus on the final buyers in addition to the dealers, hence competing with their original clients. Over the past few years, the auction houses’ business model has continued to evolve in direct competition with fine art dealers as the houses developed what they call “Private Sales”.

Evidence of this mutation can be found in the words of Sotheby’s Worldwide Head of Private Sales David Schrader. In a recent interview he outlined that the dichotomy "dealer- auction houses" is not representative of the current state of the market.

Given the new dimensions of competition, it seems natural for dealers to counter-react by persuading consignors to bypass auction houses. The unconventional move of the Morron estate, which decided to consign its collection (estimated $450M) to a pool of dealers rather than Christie’s, Phillips or Sotheby’s could be an example of that.

Still, the dealers would have needed some strong arguments to convince the Morron estate to forgo a sale at an auction house. What could these be?

Of course, there is no certain answer, but an educated guess might be found in the concept of conveying an augmented sense of exclusivity, which is highly regarded in the art market.

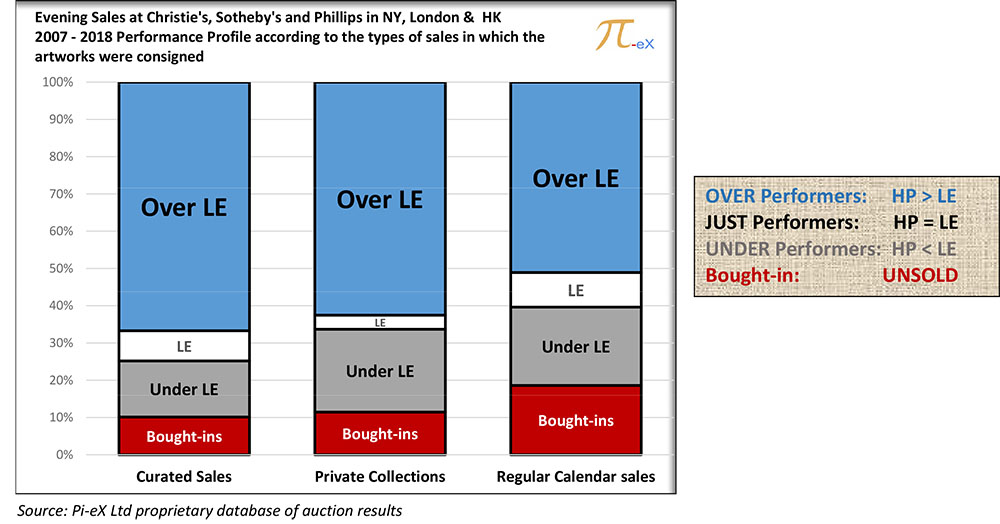

Pi-eX’s analysis of the performance of Private Collections at the top three auction houses over the past 12 years provides some interesting data on the question:

The chart below depicts the performance of lots offered at different types of sales arranged by the auction houses: Curated sales, Private Collections and Regular Calendar sales.

An acronym which fits well the trend observed in the graph above is FOMO, or Fear of Missing Out. It describes the fear of foregoing the once in a lifetime opportunity to acquire a ‘unique’ artwork owned by an important owner or specially advertised by the auction house.

And so, the more exclusive, as for example in Curated and Private Collections sales, the better the performance of the sale.

One could then argue that a sale arranged by a private dealer, as in the case of the Morron estate, is the most exclusive it gets..., as long as you trust that the dealer has enough clients to buy the collection.

Are private sales better for the sale of a Private Collection?

Private sales these days seem to be the answer for everything. As mentioned above, the Morron estate decided to sell to a pool of dealers rather than consigning at public auctions. Sotheby’s recently announced its private sales business is booming, as it reached $1B in 2019. In a similar fashion, UBS report claims that while public auction sales went down by 17% in 2019, private sales of major auction houses and dealers grew by 24% and 2% respectively.

Although encouraging, the rise of private sales should be used with caution.

As the name suggests, private sales do not require a public disclosure and so the rise or fall of them is assessed only through hypothesis and assumptions, based on voluntarily reported data.

The demand of exclusivity and discretion is certainly high, but is it always the best condition for a sale? Probably not because it comes at the cost of transparency and lack of information for art stakeholders. In a private deal a seller will never know if he could have sold for more and a buyer will never know if he could have bought for less.

Public auctions are not perfect, but they certainly are the most transparent way of selling and buying art.

Further insights on the topic of performances of Private Collections at auctions can be found in Pi-eX’s latest report: