How does this year’s crisis compare to previous art market downturns?

Posted by Pi-eX Research on 24th Sep 2020

Undoubtedly, this year’s art market downturn is unique. Caused by the shutdown of auction houses in March 2020, the crisis led to a rapid and unprecedented switch to online and live-streamed sales.

What could have been a free fall turned into the fastest technological adoption ever seen in the art market. This definitely changed the market for ever. When auction rooms were finally allowed to reopen at the end of May 2020, sellers and buyers enjoyed the return of Live sales but many continued to use the new online features made available during the months of crisis.

Hopefully, this will lead to a new period of growth in the art market. According to the Pi-eX Auction Market Index (Pi-eX AMI), the market actually has already bounced back from its June 2020 bottom.

But as the auction houses are getting ready to start the traditionally busy fall season, the question is whether the recovery will continue in the fall.

How does the downturn from the Covid19 pandemic compare to the previous art market crisis and what does it mean for the future of the art market?

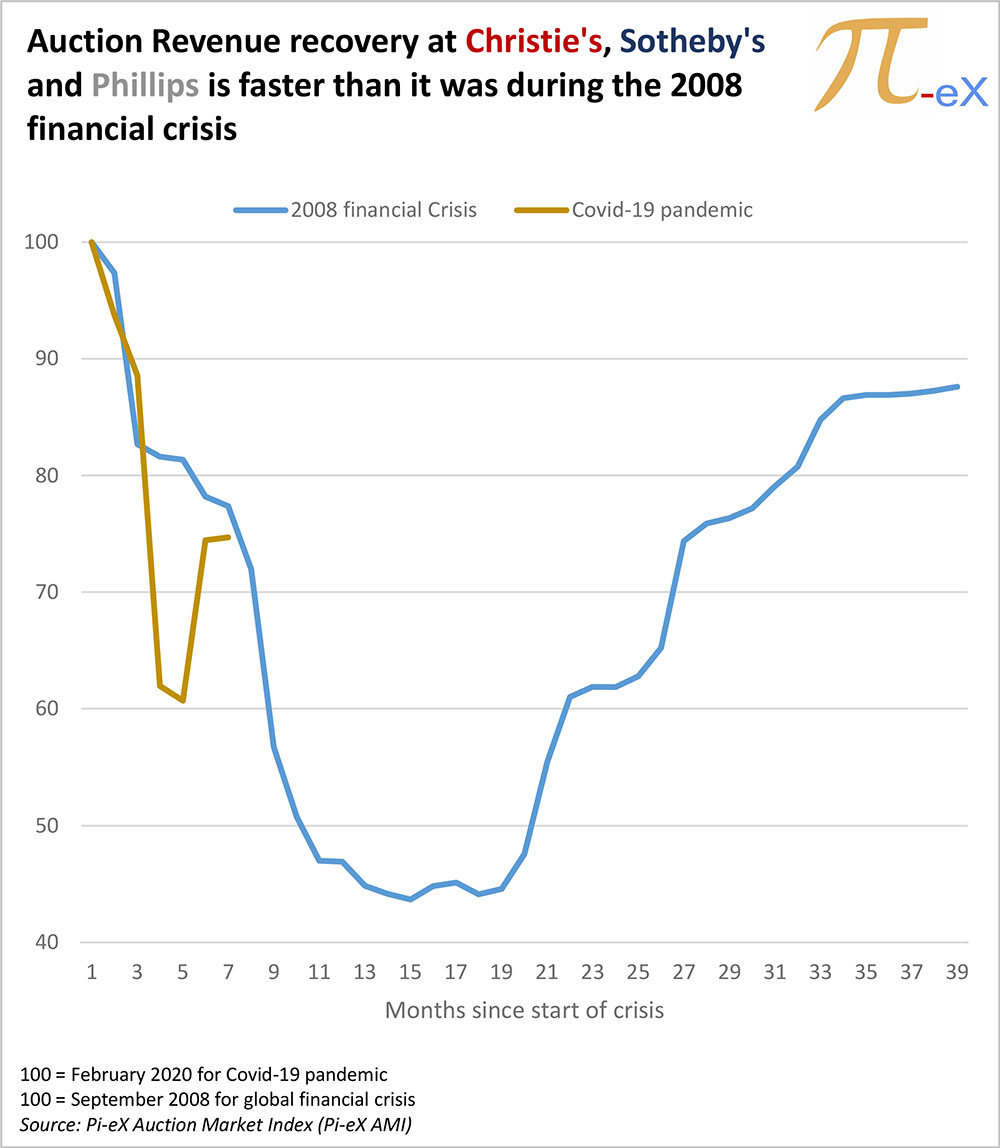

1. As of the end of August 2020, the downturn from the Covid-19 pandemic does not look as bad for auction houses as the downturn following the 2008 financial crisis:

Auction revenue did fall faster in 2020 than in 2008, but the recovery already started in July 2020 (5 months after the beginning of the Covid-19 crisis), while it took 20 months after the start of the 2008 crisis (in May 2010) to see revenue rebound at auction houses.

This is mainly due to the fundamental difference between both crises. The 2008 financial crisis turned into a liquidity crisis which dramatically affected the art market : with both sellers and buyers short on cash, the 2008 auction market experienced a long falling downturn followed by a stagnation period at the bottom of the curve.

This year is very different as the auction crisis is due to operational issues, not liquidity ones. With auction rooms closed, sellers were forced to postpone their consignments and buyers had to move online or wait until the re-opening of the auction rooms.

The rebound shown by the Pi-eX AMI in the summer 2020 confirms that buyers’ appetite for unique items has not faded and that the market is ready to get back to business when normal auction rooms conditions are available.

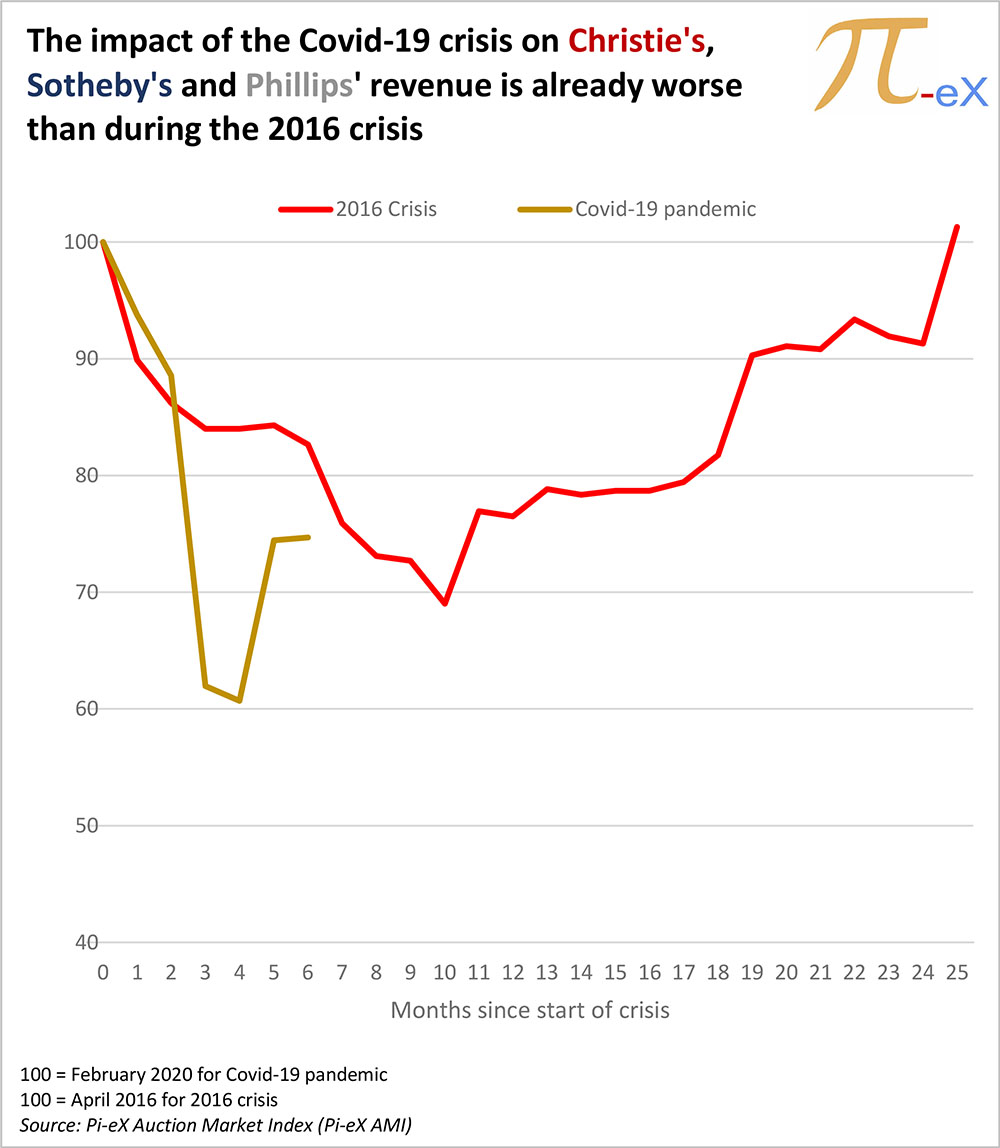

2. This year's crisis is however already worse than the 2016 art market crisis:

While better than in 2008, the drop in revenue observed on the auction market since the beginning of the Covid19 crisis is worse than that of the 2016 crisis : both in absolute value and rapidity of the fall.

The recovery however seems much faster. It took twice as much time in 2016 (10 months vs 5 months) before the come-back of growth on the auction art market.

Though uncertainty around the future of the pandemic remains, this year’s confidence crisis hardly compares to the 2016 art market confidence crisis, where political factors -Trump’s election, uncertainty over Brexit- had settled a lasting anxiety for both buyers and sellers, only soothed by the beginning of the new year in January 2017.

3. But will the growth trend last?

With a second Covid-19 wave adding to economic and political uncertainties in the fall, one can wonder whether the rebound is sustainable.

Will this year’s crisis turn into a longer confidence crisis as in 2016? Or will it become a hybrid combining features of both the 2016 and Covid19 crisis: a lasting crisis in confidence caused by uncertainty over future lockdown periods?

In this context, it seems very likely that the Pi-eX Auction Market Index will show a W-shaped recovery in the coming months: the rebound observed in July and August 2020 is mainly due to the tremendous auction houses' efforts to bring back Live sales wherever possible and combine them with the latest technological developments.

Despite all their efforts though, online sales have not so far brought in revenue to the level of Live sales, which leaves the auction business very dependent on the success of Live sales. As September, October and November are traditionally busy months for Live sales, one can worry that any new lockdown restrictions forcing the closing of auction rooms would again result in the Pi-eX AMI going down.

Lasting recovery will probably happen in a less foggy atmosphere, when auction houses will be able to open at full capacity returning to a true “Business As Usual” time.

Let’s hope that there will still be enough art for sale whether in the auction rooms or online to please enthusiastic buyers. With the ongoing surrounding uncertainty and all the time we are all likely bound to spend indoors, the motivation to hold on to a tangible asset or simply to enjoy an artwork in our home should be at its highest.

Source: Pi-eX Auction Market Index (AMI)

Anna Benoliel contributed to this report